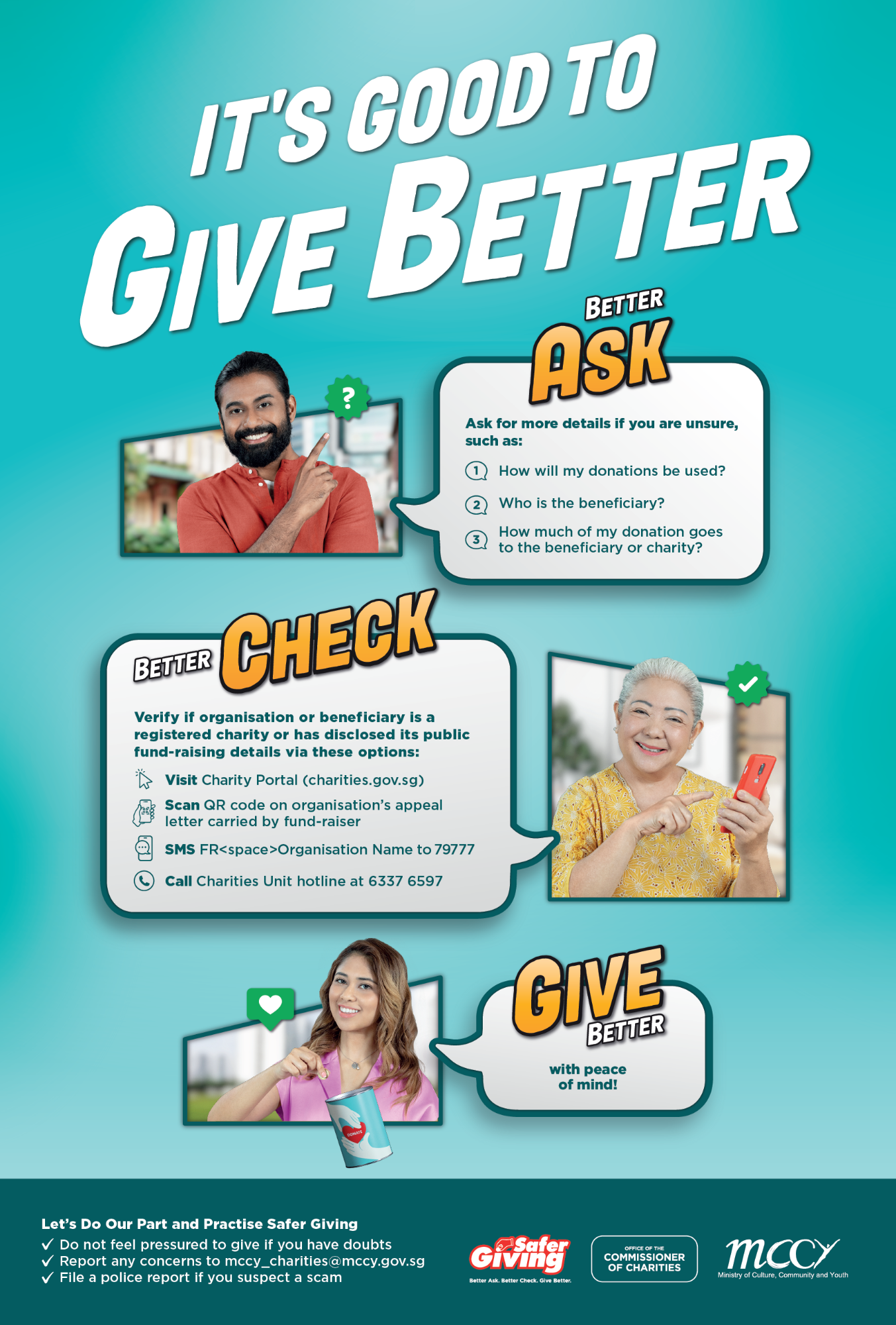

Donation

General Guidelines

- All members of the staff in this clinic are to uphold honesty in order to ensure the public's confidence and continued support for charitable causes.

- At all times, the clinic will ensure the accuracy of all information disseminated to members of the public.

- In accordance with donors' desire, all donations received will be used to the fullest in funding the free clinic.

Types of Donation

- Medical fund: donations that are specified for use in funding the operations of the free clinic, official receipts for tax exemption or non-tax exemption are issued.

- Charity box: fixed boxes placed at all branches for collection of donations from the public such donations are non-named, no specification on the usage and no issuance of receipts.

- Fund-raising activities: such as walkathon, flag day etc, to help with the operational expenses of the free clinic.

How We Spend The Donation

72.5%18.1%9.4%01020304050607000.10.20.30.40.50.60.70.80.910Operation ExpenditureAdministrative ExpenditureFundraising Expenditure

Receipt for Donations

- SBFC is an Institution of Public Character under the jurisdiction of the Ministry of Health. All qualified donations are entitled to tax relief (currently 2.5 times of donations). For more information, please visit Inland Revenue Authority of Singapore (IRAS) website.

- Donor who wish to make a tax deductible donation is required provide name as of NRIC and NRIC no. or name of corporation and UEN.

- Personal data provided by donors is deemed as acquiescence to collect, use and disclose in accordance with the Personal Data Protection Act and the SBFC Data Protection Policy for these purposes: (a) process and manage of donations received; (b) reporting to IRAS for tax relief.

- Two types of receipts are issued:

- Temporary Receipt

This type of receipt is handwritten with a set of 3 copies. The first copy is issued to the donor, the second is kept for accounting purposes and the third is the stub. - Official Receipt (computer generated, no signature is required)

- Tax-exempt receipt series MF, Pink in colour.

- None Tax-exempt receipt series NT, Blue in colour.

- Temporary Receipt

- No refund of donation once it is completed.

- If donation is unable to honour after receipt is issued, SBFC will revote the donation receipt.

- If donations could not be banked in time on the last working day of the year, offical receipts will be issued on the first working day of the following year.

Amendments of Receipts

(from non-tax deductible to tax deductible receipts OR change from tax deductible to non-tax deductible receipts)

- Amendment to receipt will not be accepted when SBFC has submitted details of donations for the previous year to Inland Revenue Authority of Singapore in January each year.

- Changes to receipt after financial year ended on 31st March is also not acceptable.

Credit Card

You could download the Donation Form, complete and email to [email protected] or through fundraising platforms Giving.sg or Give Asia.

PayNow or Bank Transfer

PayNow or bank transfer to SBFC UEN: S69SS0009J, and email your name and information to [email protected]

Cheque

Please download the Donation Form and send it together with your crossed cheque to our office at 48 Lorong 23 Geylang, Singapore 388376. Cheque payable to: Singapore Buddhist Free Clinic.

Charity Vouchers

- Members of the public can also purchase charity vouchers during celebratory events or during the demise of their friends or relatives. For amounts above $100, the purchaser can request for free delivery. (This service is not available for amounts of below $100).

- For phone-in purchases of charity vouchers; details of the purchaser, recipient and the method of payment must be clearly stated and forward the information to our Head Office in order to process.

- All funds collected from the sale of charity vouchers will be deposited into the Medical Fund. An Official receipt will be issued.

-EN-1.jpg)